Sustainable finance: What you need to know about its challenges and opportunities

Sustainable finance is a topic that has been gaining importance for governments and businesses across the world. During the MoneyLIVE APAC conference in Singapore in September 2022, Gobeyond Partners hosted a workshop to explore this issue with industry leaders and experts across the financial services ecosystem in Asia.

Here, Jasdeep Ghuman and Boon Phua look at some key insights derived from the workshop. A range of topics were raised including: why companies are pursuing sustainable finance, common obstacles they face, and what can be done to encourage sustainable finance efforts.

Let’s turn to what sustainable finance is all about; sustainable finance means also reviewing businesses’ financial decisions through the lens of Environmental, Social and Governance (ESG), with a focus on longer-term investments into sustainable projects and economic activities (World Bank). It is increasingly making its way to the top of board meeting agendas and forms a key part of strategic discussions within organisations worldwide. Momentum has been building globally as financial institutions create new products and services that align across ESG efforts, while governments are establishing new policies and standards to meet targets set out in the United Nations’ Sustainable Development Goals.

What are the drivers for companies to pursue sustainable finance?

There is now greater emphasis and expectations for companies to demonstrate the moral obligation to do the right things for their people, business, and the environment. Given that Asia is home to over 60% of the world’s population and accounts for close to half of global greenhouse gas production, the region has a critical role to play in sustainable finance.

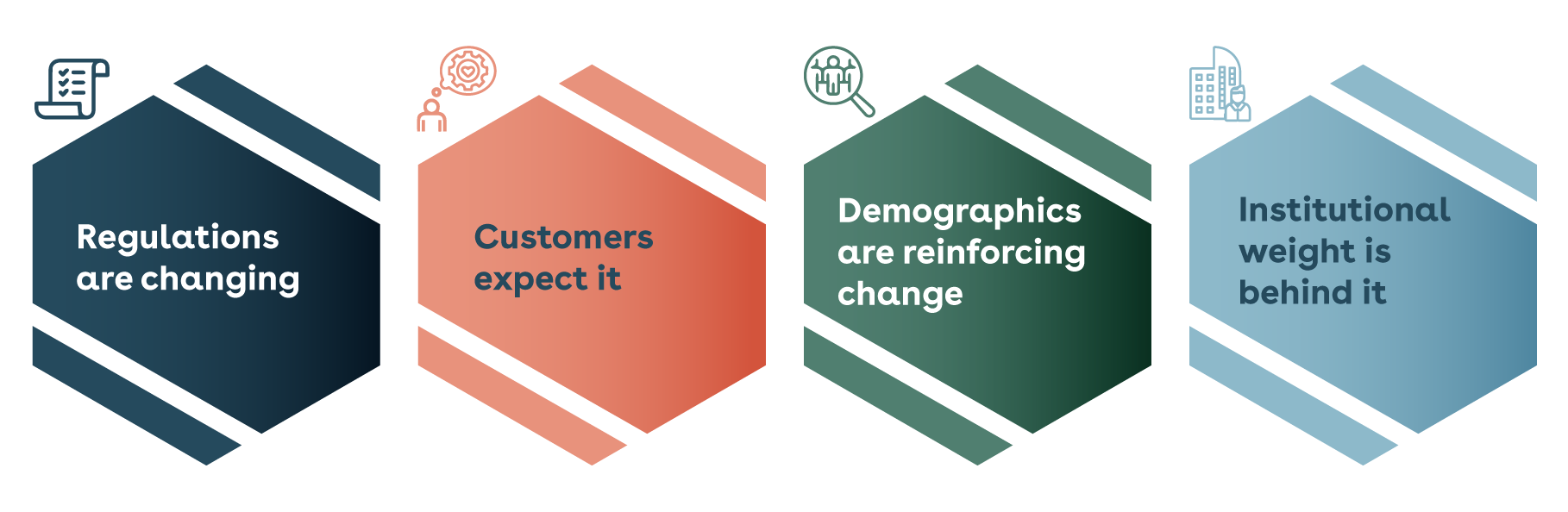

At the MoneyLIVE APAC conference in Singapore, there were robust discussions around the positives that sustainable finance has to offer businesses that choose to embrace it. Some of these benefits include: better working environments making for more engaging places to work, having a positive impact on communities, lower waste and pollution, with a move to renewable energy sources resulting in cleaner environments. Here are some of the key drivers which the group discussed:

Regulations are changing. New rules are coming being implemented as governments aim to play a significant role in the push for organisations towards sustainable finance. The need to abide by rules in such a regulated industry often puts pressure on financial institutions to accelerate change (but often not at the same pace as a profit-focused initiative for example.

Customers expect it. The scale of sustainable finance is still relatively small, but we have seen an influx of investors considering and – crucially – acting upon, their ESG considerations in the last few years. Concerns over climate change, human rights and equality all play an increasing part in their decision-making.

Demographics are reinforcing change. There is now a much larger demand for sustainable products and services by younger generations. Millennials are pushing demand for more sustainable investment offerings from financial institutions. According to KPMG, 81% of millennials were keen to know more about responsible investing and are twice as likely as older generations to want their pensions to be invested responsibly. Businesses can also leverage sustainable finance as a key Employee Value Proposition. This can attract talent who are keen to join organisations with similar values and commitments to sustainability.

Institutional weight is behind it. Linked closely to the above point on demographics, institutional investors are building ESG into their corporate strategy, with shareholders and clients expecting a broader range of investment opportunities. Organisations are also divesting from companies involved in unsustainable industries like fossil fuels, mining, and tobacco, which shifts market focus considerably. For example, some of the world’s largest national/sovereign funds have divested from investments in fossil fuels over the past few years and moved towards renewable energy investments instead.

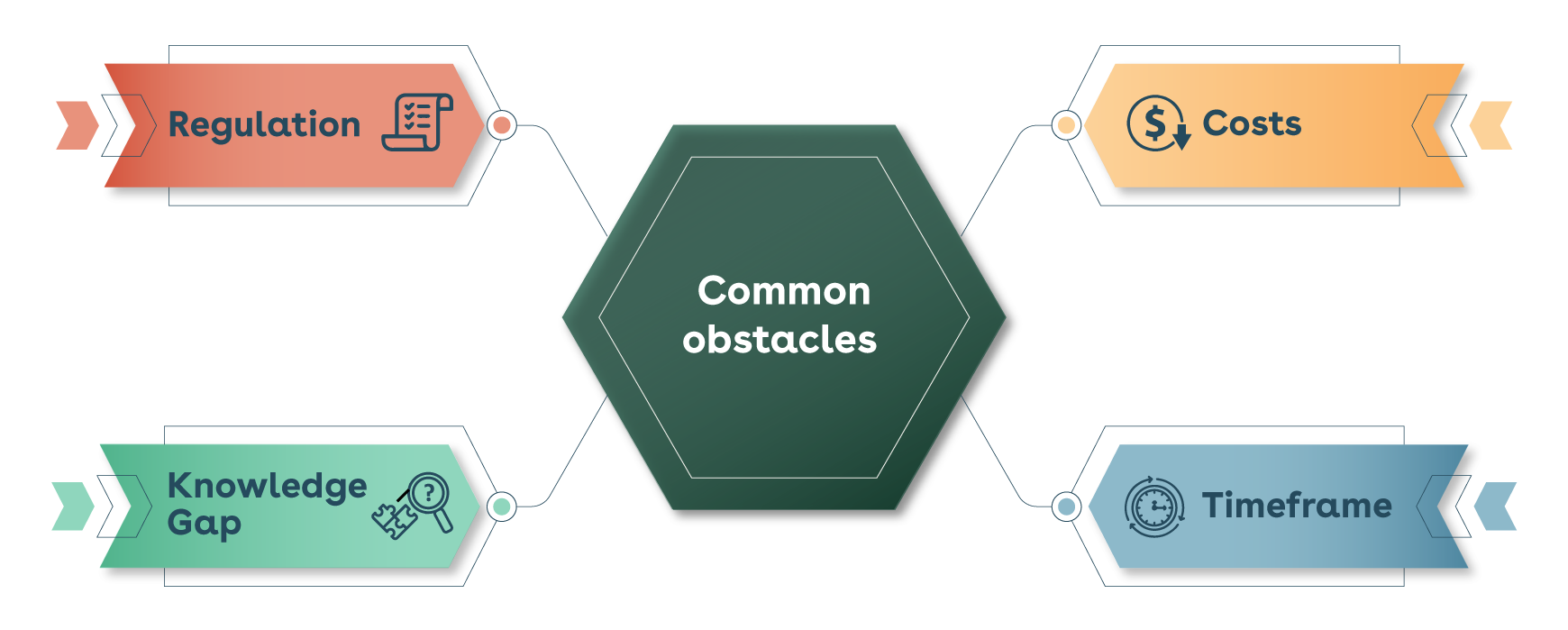

What are the common obstacles companies face?

There are challenges related to regulation, costs, knowledge and timeframe, all of which were discussed by participants at the workshop.

Regulations differ across countries and regions, and traditionally the perception is that European markets are ahead of the curve. Is there enough being done by countries to meet the targets set out? We are also seeing different regulatory interpretations across regions, which lead to inconsistent views impacting sustainability standards.

Estimated costs associated with making such big changes could very well be in the trillions of dollars, so what types of support are available for organisations to start making changes? There is also a clear knowledge gap around this topic. Sustainable finance is such a substantial and diverse subject that even amongst an experienced group at the workshop there was insufficient knowledge to cover all aspects.

Sustainable finance is often not high enough on the strategic agenda. Some participants acknowledged that their companies could do more when it comes to incorporating ESG into their business strategy.

Can corporate strategy work with the longer-term timeframe required to achieve results from sustainable finance? We found that executives are often incentivised to deliver financial results quickly, with reward packages based on short-term results. This often leads to little or no incentive to think about the bigger picture and a longer planning horizon, leading some businesses to focus solely on short-term gains.

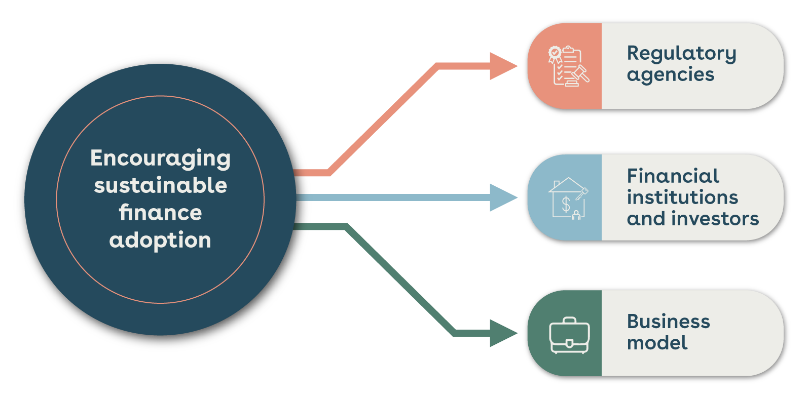

What can be done to encourage and support sustainable finance?

A key challenge, much discussed at the workshop, was how to drive greater adoption amongst industry players. While incentives, rewards, and active recognition of sustainable finance’s benefits and organisations’ ESG responsibilities can all help to push the agenda, there are active costs involved in doing so.

We explored how different groups of industry players could start to make a difference:

- Regulatory agencies – governments and central banks can play a critical role in creating a conducive environment to nurture sustainable finance efforts. For example, Singapore is Southeast Asia’s largest market for sustainable finance, and the Monetary Association of Singapore (MAS) has since supported the issuance of over USD28 billion of green and sustainability linked loans. In addition, MAS established a Green Finance Action Plan to drive adoption of sustainable finance across the region, and partners with key players to establish a vibrant sustainable finance ecosystem.

While the industry looks towards central banks and governments to establish regulations, guiding principles and ultimately incentives around sustainable finance, regulatory bodies face challenges in doing so. Some of the concerns raised at the workshop include the need for regulators to ensure a level playing field, and questions around the ability to finance costs of such incentives.

While there is no one-size-fits-all solution, regulators could start by obtaining a clearer understanding on the intent behind best practices of other countries, and then assess the viability of implementing these practices internally.

- Financial institutions and investors – according to the United Nations, 80% of the investment industry and more than 260 banks have committed to both the Principles for Responsible Investment and Principles for Responsible Banking. This represents at least USD2.3 trillion in sustainable financing since 2019. While critics have called out discrepancies between some institutions’ commitments and their actual investments, improvements to reduce greenwashing have definitely been made.

The concept of green banking is less prevalent in Asia than in Europe and the United States. To target the consumers ready for change and are willing to support sustainable financing, banks and insurers in Asia could consider introducing green banking products. This could provide a key differentiator and help capture first mover advantage. Private investors should make a concerted effort not to invest in companies or industries deemed unsustainable. Perhaps a testament to the industry’s efforts, the International Monetary Fund estimated the current value of ESG-related funds to be some USD 31 trillion, with investments set to grow even further.

- Businesses – companies should actively embed sustainable finance into their core business model and seek to generate benefits for themselves and their customers. Rewards and recognitions can be changed to advocate longer-term investments in ESG efforts and products. Training can also be proactively provided to bridge the awareness and capabilities gap, particularly amongst middle management.

This does not just apply to large entities, as small and medium enterprises (SME) can make a difference as well. According to the World Economic Forum, there are over 62 million SMEs in Indonesia, Southeast Asia’s most populated country. This translates to one SME for every five Indonesians, and if they too are able to push for sustainable finance, these tiny ripples could culminate in a sizable momentum.

A collaborative approach

A major takeaway from the workshop was that, too often, industry players try to advance efforts in silos or adopt a wait-and-see approach. A more collaborative approach is needed, for example through the form of private-public partnerships or adopting an ecosystem approach to support sustainable finance initiatives.

Contact us (Boon Phua via boon.phua@gobeyondpartners.com) to progress this topic further and build on how your organisation can make a difference through ESG and sustainable finance efforts.

About Gobeyond Partners

Gobeyond Partners is a new type of consulting firm that partners with its clients to solve complex customer journey challenges. By combining deep sector expertise with an award-winning approach to client service and value, Gobeyond Partners brings its clients’ transformation vision to life.

Part of the Webhelp group, the team at Gobeyond Partners operates globally - understanding what it takes to transform organisations in the face of changing customer behaviours, cost pressures, and legacy systems.

The firm’s unique customer journey view is broad and deep, helping clients break down organisational silos and deliver a fully connected omnichannel customer experience.