Article: The Green Real Estate Conundrum

Contributed by Andrew Xiao (APAC Technical Program Manager for CBRE at Google) representing our Built Environment Committee, and by Robin Teh (Chartered Surveyor and Ex-JLL Head of Advisory) who has over 20 years of valuation experience in the Middle East, North Asia and Singapore.

This article features is part of our new Road to Net Zero series of activities and content.

Introduction

The embodied carbon associated with buildings engenders global warming and climate change. The World Green Building Council affirms the building sector has accounted for 30 – 40% of the global carbon dioxide emission and energy consumption, and expends 40% – 50% of world’s raw material. The threat of global warming and science substantiating climate change is real, now more than ever. In 2018, the Guardian reported a terrifying heatwave in the sunless winter Arctic had resulted in an unprecedented influx of warm air, where the temperature in Siberia had risen as much as 35°C above historical averages and the average daily temperatures in the Arctic had been 20°C warmer than average. If global warming is to be maintained under 2°C, in accordance with the Paris agreement, every building should ideally be operating at “net zero carbon” by 2050.

The reliance on buildings for shelter and livelihood is elemental and axiomatic. It is sensible, or even, intuitive to promote sustainable and energy efficient real estate (a.k.a. Green Buildings) to attenuate adverse environmental impacts. Although Green Buildings are synonymous with resource conservation, mitigating economic externalities and levelling environmental inequalities, they have so far been prevalent in the developed countries. Despite the proliferation of green buildings’ regulatory policies, the paucity of green buildings reaching critical mass suggests investors’ reservations.

Vast majority of the publications are anecdotally limited to the normative propositions of how sustainability initiatives (e.g. certification, ESD features or technologies) ‘should’ affect property value which emphasise “green premium” and/or “business case”, such as rent or occupancy premium, branding and marketability premium and OPEX savings. Although these are seemingly beneficial to policy-making and strategizing of portfolio investments, more often than not, they are independent from market-determined appraisals. Unless tangible evidence is available to consistently warrant the positive impacts on property value attributed by sustainability features intrinsic to the green buildings, there is limited motivation amongst the appraising community to adjust the existing valuation parameters. The relevance of “green premium” or “brown discount” is only relative to present-day market trends (i.e. brown discount applies only when there is a greater demand for Green Buildings than conventional building, with the provision that the tenants are not constrained by the availability of options in the market). The effect of present-day “green premium” or “brown discount” on asset valuation, will apply when a specific asset outperforms or underperforms the prevailing market trend.

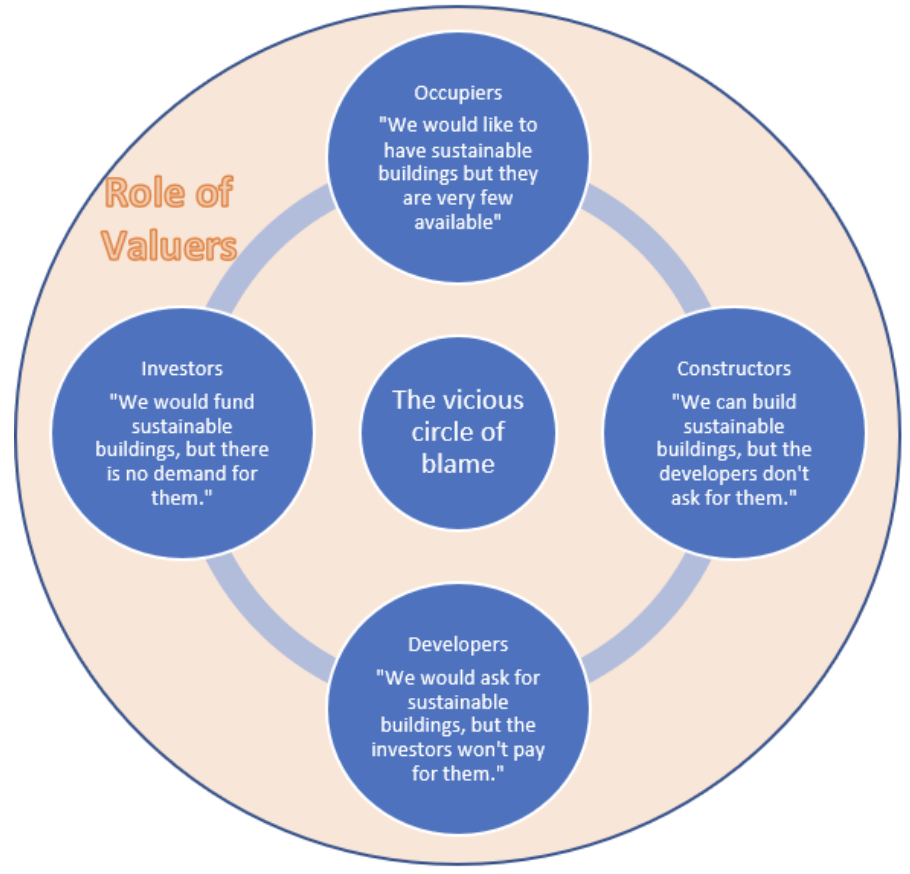

The emergence of millennials in the workforce has shifted the demographics, and also the requirements of workspaces. CBRE (2018) survey suggests that the workspace experience, proximity to public transportation, amenities and services, wellness and corporate environmental and social governance are integral to millennials’ acceptance of employment. More recently, Covid-19 has prompted the incumbents to accelerate the implementation of wellness measures in the workplace, driving the demand for enhanced air quality, ventilation systems, amongst other indoor environmental features (CBRE, 2020). As societal values evolve to emphasize sustainability, ranging from individual consumption behaviours to corporate business models, so will the real estate decisions be orientated towards Socially Responsible Investing and Corporate Social Responsibility. This is supported by CoreNet Global and Jones Lang LaSalle annual sustainability surveys which report 89% of commercial real estate professionals incorporate sustainability in business operations (CoreNet and JLL, 2009). However, it is empirically evident that voluntary investments towards the green buildings have been inadequate (CBRE, 2011). Cadman’s concept of the “vicious cycle of blame” (Figure-1) amongst the market stakeholders illustrates the misalignment between the investors and occupiers. Investments are limited by unsatisfactory financial returns, attributed by perceived development cost premium, weak market demand and uncertainty encompassing market value. Therefore, the assessment of investment feasibility must entail the avenues of costs and benefits comprehensively. Weak financial feasibility inevitably limits green building investments. If the value proposition is not prominently recognized, the market forces will limit rent and occupancy premiums, and the capital value or valuation premium associated with green buildings. At the same time, many argue that investors have characteristically not held assets from cradle to grave. Moreover, triple net lease on property requires tenants or occupiers to be liable for all taxes, insurance, and maintenance, on top of the normative tenancy terms. The benefits attributable from reduced OPEX are excluded from the economic standpoint. Unless sustainability attributes transcend to capital value gain, the failure to maintain satisfactory investment returns will disincentivise investors’ commitment to higher CAPEX idiosyncratic to green buildings.

The role of valuers as advisors to respective stakeholders could be the missing puzzle piece to investors’ apathetic attitude. Valuation, therefore holds the key to revolutionise the green building investment if the value-added perceived today transcends to the added-value tomorrow. Undoubtedly, the statistical data and economics underpinning green buildings is fundamentally one of the key attributes to the proliferation of sustainable real estates.

Figure-1: The vicious circle of blame and the Role of Valuers (Adapted from Cadman, 2000).

The Role of Appraiser in Valuation

As defined by the Royal Institute of Chartered Surveyors (RICS), Valuation is defined as the determination of an opinion of the value of an asset based on an arm’s length transaction assuming full disclosure and in consideration of the present market forces at play. The process requires the combination of discretionary judgments and econometric interpretations for market-based valuation (e.g. sales and rent) or theoretical valuation (e.g. mortgages, financial loans, tax compensation) by the valuers per se. Therefore, valuation is the expression of asset value as a function of, but not limited to, net income, occupancy rate, tenants profile, locality, age and building typology. Subjected to the aims of valuation, the concepts of value can be broadly categorised as market value or worth. Worth is the opinion of value or function of an asset's performance peculiar to the prerequisites of the investment-centric stakeholders. It is the approximation of the client's anticipated net benefits. On the contrary, market value (a.k.a. transacted value) is market-determined and influenced by price-determining factors (i.e. macro- and micro-economics).

A licensed appraiser/valuer possesses technical competence in approximating the market-value of a property, factoring in foreseeable event occurrence and its associated cost. The role of the appraiser should not be creating positive value to lead the market but to capture the dynamics of market forces (e.g. macro and micro economic factors, corporate, social and environmental requirements) that will influence the decisions of buyers and/or sellers. Therefore, if the market sentiment grows towards sustainability, appraisers shall correspondingly reflect the impacts of sustainability on asset value that underpin future investment decisions. The appraiser holds the potential to engender the proliferation of green buildings, should the effect of sustainability on asset value be distinctively measured, empirically evidenced and monetised to reflect the effects of sustainability performance on property value. Change within the valuation profession is imminent. However, the resistance to change is attributable to the multiplexity of market forces at the genesis of valuation, such as interlaying sustainability attributes to occupancy or vacancy rates, rent or sale premium, market yield, passing rent and capitalisation rates.

Although third-party green building accreditation framework (e.g. LEED and WELL), in parallel with industry-published case studies and circulars, are widely suggested to reconcile information asymmetries and to reinstate market confidence, such practices are sketchily technocratic, or perhaps impractical, to reflect the cyclical volatility of real estate valuation – characterised by price mechanism and market forces (e.g. economic cycle, supply and demand, market-determined value, perceived worth, obsolescence risk mitigation, willingness-to-pay, etc.). Besides, the risk for litigious implications for the profession escalates when hedonistic valuers misrepresent the effects of sustainability features on asset valuations. Distorted valuation prompts investors’ apprehension and is detrimental to future green building investment. Ultimately, the authenticity of monetising sustainability in asset value is underpinned by the valuer’s professionalism.

The Future of Green Buildings

What are some of the drivers for GBs?

The drivers of GBs are broadly categorised based on top-down approach and bottom-up approach. The former comprises legislation and strategic implementation of incentive schemes congruent to national targets. For instance, Dubai Supreme Council of Energy commits to reduce 30% of the city’s energy demand by 2030 and imposes minimum sustainability performance on private, public and industrial new developments under Al Sa’fat assessment framework. Likewise, Green-Mark framework is imposed on new and existing buildings in Singapore in view of greening 80% of the building stocks by 2030. Incentive schemes vary in the form of monetary reimbursements, tax incentives, subsidised financing or additional GFA grant.

The bottom-up approach is demanded by end-users with the advent of environmental consciousness. The increased competition from good quality commercial buildings during the construction boom compel developers to adopt LEED certification for the attraction and/or retention of blue-chip tenants. For instance, the headquarters of HSBC, Standard Chartered and Mashreq Banks, and General Electric Headquarters have pursued LEED certifications respectively. Green buildings investment from the developer’s perspective is synonymous to corporate social responsibility priorities, market-differentiation and capitalisation rate attributed to effective net operating income.

What are some of the challenges from the investors’ perspective that limit GB investment?

Green Buildings are characteristically perceived to incur higher capital expenditure. Especially in times of financial credit crunch (e.g. 2007 recession), such investment is the least considered and resonated with occupiers’ unwillingness-to-pay for green offices. Undoubtedly, investment is dependent on market perceived value and market demand, the paucity of published data, such as occupancy rates, rental and sales premiums, amongst others, impedes the proliferation of Green Building investment. However, it is anecdotally difficult to standardise measurable data, which inevitably compromises the accuracy of downstream inferences. Perhaps to invigorate green building investments, steadfast governmental commitment is required to aid long-term sustainability aspirations. However, the unpredictability of governance engenders policies volatility. For example, the intent to withdraw the United States from the Paris Climate accord announced in 2017 or the termination of the UK’s Green Deal following the July 2015 election.

Can Green Buildings proliferate without governmental interventions?

There is a propensity for developers to fulfil basic compliance. Although a handful of visionary market leaders will pursue green building investment for market differentiation, the newly-built Gate Village 11 in Dubai International Financial Centre, as an example, was designed to achieve LEED Silver, presumably consequential to value-engineering than a long-term vision. Constructing sustainable real estate inflates budget and project risk. Unless the asset is privately-owned or owner occupied for long-term capital appreciation or driven by regulatory legislation, green building investment has yet to resonate unanimously amongst stakeholders for a paradigm shift.

Although the awareness for wellness and sustainability has gained much traction and relevance to-date, it is subjected to the occupiers’ willingness-to-pay, preference of locality and prevailing market conditions. For example, in a market where the vacancy rate in the prime district is approximately 2% or lesser, to what extent will the blue-chip tenants be willing to compromise their tenancy options or to incur hefty rental premiums for CSR compliance.

Developers’ indifferent attitude towards green building investment and occupiers’ unwillingness-to-pay reiterate Cadman’s concept of Vicious Circle of Blame. The role of valuers to value assets based on what is presently attractive (i.e. green premium) and disadvantageous (i.e. brown discount) to the investor is pivotal. For example, should a government mandate 30% energy savings through the like of renewable energy or heat recovery or smart building automation, etc., valuers will factor in fixed premiums/penalties according to the market sentiments. Ultimately, in the absence of government intervention, the Vicious Circle of Blame will remain status quo.

What can be done to promote or incentivise GB investments?

Incentive schemes in the forms of additional GFA, monetary or tax reimbursements or subsidized financing schemes, to promote green building investments are widely acknowledged. However, monetary incentives are critiqued as unnecessary fiscal expenditures, detrimental to effective economic growth. GFA incentive, on the contrary, is recognised as a self-sustaining model and has set precedence in Singapore and Hong Kong. Notwithstanding, it is paradoxical to investments that are hypersensitive to market mechanisms. The market demand reflects the market perceived value of the property, reiterating the importance of appraising green buildings accurately to incentivise future investments - chicken or egg paradox. Paucity in published empirical variables to precisely adjust valuation, remains an industry challenge to promote green building investments.