Singapore key exports in surprise rebound but face headwinds from renewed US-China trade tensions

(PHOTO: ST FILE)

Source: The Straits Times

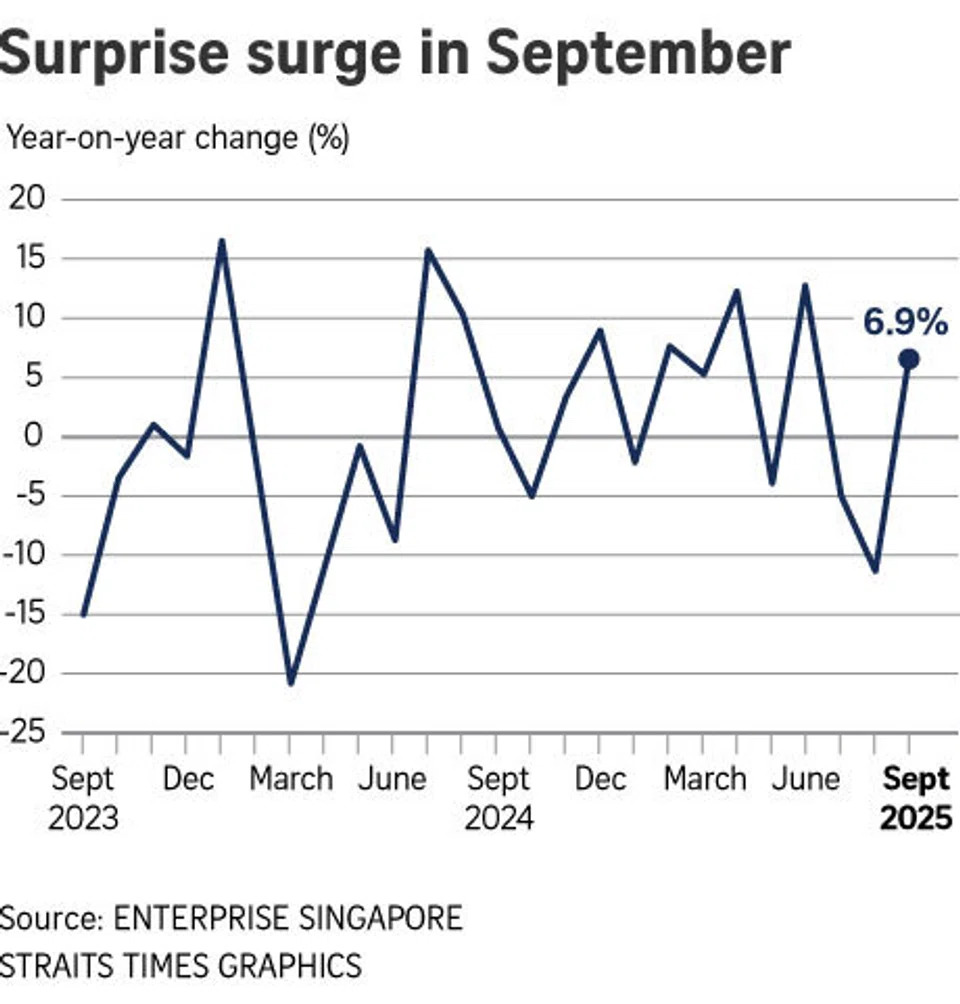

Singapore key exports staged a surprise rebound in September on the back of a surge in electronics shipments, but analysts said the outlook is clouded by renewed US-China trade tensions.

Non-oil domestic exports (Nodx) grew 6.9 per cent year on year, compared with a revised 11.5 per cent drop in August, according to figures released by trade agency Enterprise Singapore on Oct 17.

Economists polled by Bloomberg had forecast Nodx to shrink 2.1 per cent in September.

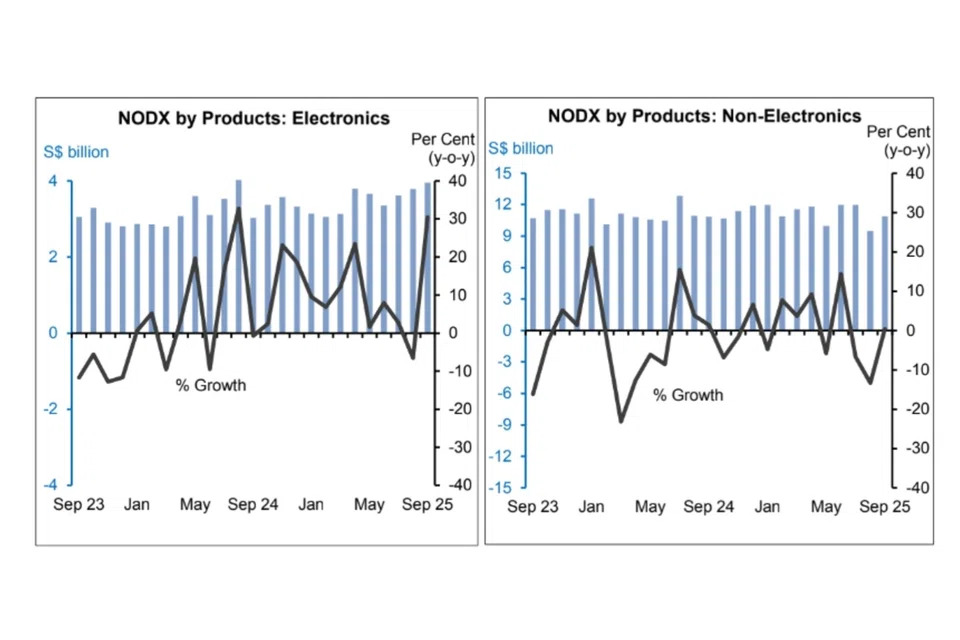

Electronics exports surged 30.4 per cent year on year, compared with the 6.5 per cent decline in August. Growth was underpinned by personal computers, disk media products and integrated circuits.

DBS Bank senior economist Chua Han Teng said the rise in electronics exports was partly due to a lower base of comparison from a year ago.

“It also stems from firm external demand bolstered by positive artificial intelligence-related developments and US tariff exemptions on electronics,” he said.

Maybank economist Chua Hak Bin said electronics exports have also been supported by strong demand for semiconductors and equipment such as servers, disk drives, telecommunications gear and cooling system components, amid an acceleration in data centre construction.

Non-electronics exports edged up 0.4 per cent in September, reversing a revised 13.3 per cent drop in August.

OCBC Bank chief economist Selena Ling said the volatility of the monthly Nodx data reflects the “rapidly shifting global economic and trade environment”.

“With the re-escalation of US-China trade tensions of late, Singapore should probably brace itself for more stops and starts in this roller-coaster ride,” she said.

Non-monetary gold led the charge with an 82.7 per cent expansion, while specialised machinery grew 14.1 per cent.

Key exports to Hong Kong, Taiwan and China expanded in September, though shipments to the European Union (EU), the US and Indonesia declined.

The main drag came from the EU, where shipments tumbled 20.5 per cent – a sharp reversal from the 29 per cent surge in August.

Shipments to the US fell 9.9 per cent, a smaller decline than August’s 29.1 per cent drop.

Shipments to Hong Kong jumped 56.3 per cent – reversing August’s 20.9 per cent decline – owing to integrated chips, non-monetary gold and specialised machinery.

Shipments to Taiwan rose 31.9 per cent, building on the 9.1 per cent rise in August, thanks to integrated chips, specialised machinery and pharmaceuticals.

Exports to China grew by 10.1 per cent in September, following the 22 per cent contraction in the preceding month, owing to specialised machinery, measuring instruments and integrated chips.

On Singapore-based pharmaceutical companies awaiting confirmation of tariff exemptions, Maybank’s Dr Chua said major multinational drugmakers here are likely to be exempted from the 100 per cent tariffs imposed by the US, as most are expanding and investing in the world’s largest economy.

“We expect export growth to recover in the fourth quarter after a weak third,” he added.

Mr Zavier Wong, market analyst at trading platform eToro, said the rebound in Nodx looks less like a revival and more like “compensation” for August’s sharp decline.

“The divergence in export numbers underlines what’s really going on here, and that is goods are being rerouted through Asia’s hubs instead of across the ocean,” he said.

“The shift says something about where Singapore sits in the global chain – trades are regionalising and being rewired around tariffs, but our exporters are adapting well, quietly finding balance through their partners in Asean and China.”

Mr Wong added: “But it’s worth noting that adaptation isn’t without pain points... We see order books shrinking, margins thinning and the year-end tariff overhang still clouds visibility.”