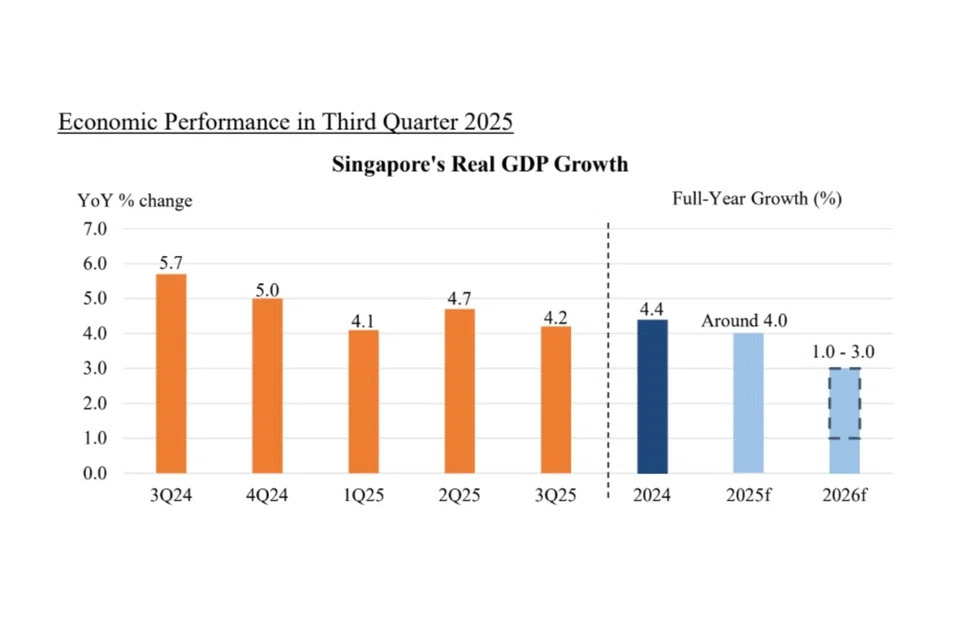

Singapore hikes 2025 GDP growth forecast to around 4%, sees 1%-3% growth in 2026

(Photo credit: ST File)

Source: The Straits Times

Singapore sharply raised its 2025 economic growth forecast after a better-than-expected performance in the third quarter of the year, but expects the pace of expansion to ease in 2026 on US tariff effects.

The gross domestic product (GDP) growth forecast was raised to “around 4 per cent” from the 1.5 per cent to 2.5 per cent range projected in August by the Ministry of Trade and Industry (MTI).

In its first forecast for 2026, MTI said the economy is likely to grow by a slower 1 per cent to 3 per cent.

“I think the risk factors are real,” said Permanent Secretary for Trade and Industry Beh Swan Gin at a media briefing on Nov 21. “We continue to be concerned that there could always be a re-escalation of the trade tensions.”

MTI’s 2025 growth upgrade comes after the economy grew 4.2 per cent year on year in the third quarter, higher than its earlier estimate of 2.9 per cent.

On a seasonally adjusted quarterly basis, the economy grew 2.4 per cent in the third quarter, faster than the 1.7 per cent expansion in the previous three months.

MTI said GDP growth for the first three quarters of 2025 averages at 4.3 per cent year on year. That average is just shy of the 4.4 per cent growth Singapore achieved in the whole of 2024.

Expectations of a surge in GDP had risen after factory output returned to expansion territory with a 16.1 per cent year-on-year surge in September, a rebound from August’s revised 9 per cent drop, data from the Economic Development Board showed in October.

The figure was well above the 7.5 per cent rise forecast by economists in a Bloomberg poll.

Meanwhile, non-oil domestic exports (NODX) jumped 22.2 per cent from a year ago in October, from a revised 7 per cent expansion in September, data from Enterprise Singapore showed on Nov 17.

NODX is up by 4.1 per cent in the first 10 months of 2025, although Enterprise Singapore still expects full-year NODX growth to come in at around 2.5 per cent.

Total exports – which include re-exports and are used for GDP calculation – rose 8.2 per cent in the third quarter, slightly lower than the 11.6 per cent recorded in the second quarter. In October, however, total exports jumped 25.2 per cent, extending the previous month’s 14.5 per cent rise.

The surge in October exports showed that economic growth momentum might continue to stay strong in the fourth quarter as well.

Many analysts have raised their forecasts for 2025 GDP growth to levels higher than those projected by MTI in August.

Dr Beh said: “Trade-related sectors such as the manufacturing, wholesale trade and transportation and storage sectors outperformed expectations, supported by the resilience of our trading partners and global trade.”

The third-quarter GDP breakdown showed that the electronics cluster expanded by 6.1 per cent amid a significant increase in the demand for artificial intelligence-related semiconductors, servers and server-related products.

Within the cluster, the infocomm and consumer electronics segment expanded robustly by 67.6 per cent, driven by a higher level of production of servers and server-related products.

Meanwhile, the biomedical manufacturing cluster grew 8.9 per cent, supported by a higher-than-expected level of production of a key high-value active pharmaceutical ingredient.

MTI said the August GDP upgrade was based on strong front-loading activities in the second quarter of 2025 due to the pause in the US’ reciprocal tariffs, as well as an improvement in the outlook for Singapore’s external demand due to the de-escalation in trade tensions between the US and several of its trading partners.

Front-loading refers to advance orders by importers to stockpile goods and get ahead of an expected increase in tariffs.

However, at that time, MTI had expected global growth to slow down in the second half of the year, with the dissipation of the boost from front-loading activities and the reinstatement of US reciprocal tariffs after the temporary pause.

Since then, global economic conditions have turned out to be more resilient than expected, said the ministry. GDP growth in most of Singapore’s key trading partners came in better than expected in the third quarter of 2025.

At the same time, the stronger-than-anticipated artificial intelligence boom provided support for US economic growth, and for the exports of AI-related semiconductors from the region.

There have also been further de-escalations in trade tensions recently. Notably, the US-China trade truce has been extended to November 2026 with a reduced US tariff rate on China.

Meanwhile, the US roll-out of the sectoral tariffs on semiconductors and pharmaceuticals has been slower than earlier anticipated, said MTI.

However, the ministry said the manufacturing and trade-related services sectors in Singapore are projected to expand at a slower pace in the year ahead compared with 2025.

It also warned that downside risks remain in the global economy. While global economic uncertainty has receded since the first half of 2025, it remains elevated.

Dr Beh said that tariffs take time to feed into the economy – both in the US and the rest of the world.

“That is why we expect the effect (of tariffs) to be more pronounced in 2026,” he said.

He added that for a mature economy such as Singapore, a 2 per cent to 3 per cent growth should be expected. “So 1 to 3 per cent (forecast for 2026) is not unduly pessimistic,” he said.

MTI believes a renewed escalation in tariff actions or geopolitical tensions could lead to a resurgence in economic uncertainty, which would weigh on sentiments and cause businesses and households to pull back on hiring, investment and spending.

Also, an escalation in risk-off sentiments could trigger sharp corrections in global financial markets, with potential spillovers to broader economic growth.

DBS Group senior economist Chua Han Teng said MTI’s 2026 forecast appears to anticipate “measured resilience”, which refers to an economy’s ability to withstand shocks and adapt quickly to a new scenario.

He said the upper bound of the 1 per cent to 3 per cent estimate is near the potential for Singapore’s economy. “However, the MTI’s lower bound leaves scope for a deeper cyclical downturn from unexpected negative shocks.”

DBS expects Singapore’s GDP growth to come in at 4 per cent in 2025 and then moderate to 1.8 per cent in 2026.

OCBC Bank chief economist Selena Ling said MTI’s lower forecast also includes short-term headwinds to semiconductor equipment makers from potential US tariffs. Semiconductors so far remain exempt from levies.