The New World of Wealth — COVID-19 Has Singaporeans Saving More and Worried About Retirement

A new study by St. James’s Place Wealth Management Asia (“SJP Asia”) launched in April reveals the impact the COVID-19 pandemic has had on Singaporeans’ approach to financial management.

A little over one year on from when Singapore first enacted its circuit breaker measures, the study, titled The New World of Wealth, highlights key trends and areas of concern in managing finances for many Singaporeans as they look towards recovery and reinvesting in the future in 2021.

Increased Pressure on Savings and Retirement Planning

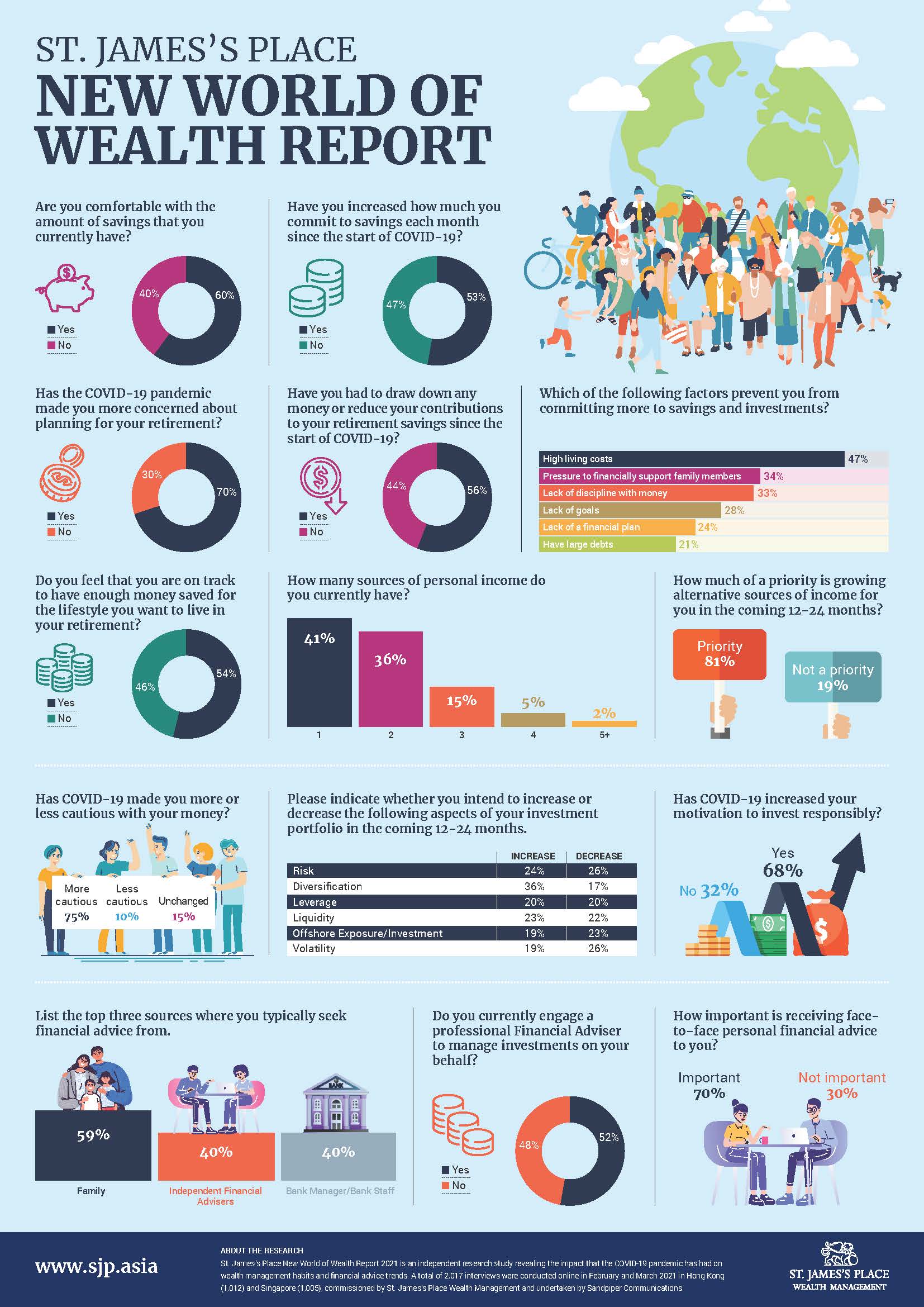

While two in five (40%) of Singaporeans are not comfortable with their current savings, over half (53%) say they have increased their monthly savings since the onset of COVID-19. The main barriers preventing consumers from saving more are higher living costs (47%) and increasing pressure to support their families (34%).

70% say the pandemic has made them much more concerned about planning for retirement. However, concerningly, 56% have had to draw down on or reduce contributions to their retirement savings since the start of COVID-19, with 20% having to do so in a significant way.

Almost half (46%) say they are not on track to have enough saved for the lifestyle they want to live in retirement. As the COVID-19 pandemic shifts expectations of work and income stability, 81% say that it is a priority for them to grow additional income streams in the future.

Gary Harvey, CEO, SJP Singapore, said:

“The pandemic has had a significant financial impact on many Singaporeans and we see that many are more cautious with their money as a result. It is concerning that within this trend we see people borrowing from the future to pay for their costs today, with a reduced focused on retirement planning.”

Changing Attitudes to Investing

With the global economic uncertainty brought about by the pandemic, three quarters (75%) of Singaporeans say they are now more cautious with their money. Younger investors (25-34 years, 71%) are distinctly more cautious than older investors (45+ years, 79%) by as much as eight basis points. However, a “flight to safety” and withdrawing from investments towards more cash-based holdings may be the wrong long-term approach for generating value. Many investors recognise this in terms of asset allocation, and have actually increased their investments in equities (49%), exchangetraded funds (49%) and managed funds (42%).

There has also been a significant shift in investment attitudes since the start of the pandemic. 36% of Singaporeans intend to increase diversification in their portfolio (from 33% in 2020), while 26% have decreased their exposure to risk (from 29% in 2020) as they look for perceived safer investment options.

Positively, COVID-19 has raised the awareness of Environmental, Societal and Governance (ESG) issues among investors, with 68% saying that the pandemic has increased their motivation to invest responsibly.

Gary Harvey, CEO, SJP Singapore, said:

“With investors generally understanding the need to be more cautious and diversified thanks to COVID-19, there is an opportunity for many to adopt a more traditional investment approach that prioritises long-term fundamentals. An equally important part of this will be how they approach ESG issues and invest responsibly, which has grown in prominence over the past year.”

Increased Appetite for Advice

While family (59%) remains the top source of financial advice for many Singaporeans, COVID-19 has seen an increase in Singaporeans seeking out professionals for financial advice, with 40% saying independent financial advisers and bankers are now their top source of advice (up from 26% and 35% respectively in 2020).

While three quarters (75%) of Singaporeans highlight a need for more financial advice, just over half (52%) are currently engaging a financial adviser.

In spite of the many restrictions on physical meetings and gatherings, face-to-face communication is still highly sought after by Singaporean investors. 70% said that this was important to them when engaging financial advice, highlighting investors’ needs for consistent engagement and re-evaluation of their financial situations amid a period of high uncertainty.

Gary Harvey, CEO, SJP Singapore, said:

“With more investors seeking out safety, the need for solid financial advice grounded in experience is greater than ever. There are many new challenges for investors in the new world of wealth, but the guiding principles for success are still the same. Investors must be prudent and undertake robust financial planning to understand what gaps they have in their long-term wealth strategy.”