- Home

- knowledge bank

- future pharma market access new model next normal

The Future of Pharma Market Access: A New Model for The ‘Next Normal’

The new model of access strategy should build around four key pillars, says Jeff Weisel, Senior Advisor Asia-Pacific at PRMA Consulting. In this update, Jeff explores why the shifting currents of global healthcare are dictating a new approach to market access.

Just over three years ago, I published an article on “Rethinking Access” in which I set out some perspectives on how the changes underway in the biopharmaceutical industry would impact the way that companies addressed market access going forward.

Given all that has transpired since that time, especially for an industry at the center of the response to the global COVID-19 pandemic, it is a good moment to revisit some of the themes from that article, see how the approach to access has evolved, and explore why a new approach to access should be built on four pillars of:

- Driving access and value across the product life cycle

- Shifting emphasis from product access to patient access (and outcomes)

- Focusing on the ‘job to be done’ – not the organization chart

- Adding ‘art’ to the science – embracing digital and business model innovation.

The new model of access strategy should build around four key pillars

PRMA Consulting®

PRMA Consulting®

Back to the future: the evolution of market access

To understand the future of market access, we must first circle back to its origins and how it has evolved to the present day. Market access emerged as an integrated function in most biopharmaceutical companies in the early 2000s as a response to the increasingly central role of the payer in healthcare systems. The focus was on securing reimbursement for new medicines at a commercially attractive price with broad treatment guidelines in a reasonable timeframe. This objective was (and still is) mostly accomplished by submitting formal dossiers to national insurance agencies and managed care organizations for reimbursement approval using cost-benefit models that utilized health economics analysis.

This new approach was largely successful in an environment still dominated by mass-market blockbusters in developed markets where the payers had supplanted physicians as the primary drivers of treatment decisions. However, as the environment has changed dramatically in recent years, both internally and externally, drug companies have had to rethink market access as both a strategic objective and an operational activity.

Worlds in collision

However, that world has long since passed. In 2018, a structural revolution was already well under way as most of the traditional primary care blockbusters had already fallen over the ‘patent cliff’. These products targeted large patient populations at relatively low prices and, as they went generic, payers shifted expenditure to newer therapies. Since that time, a number of companies have since restructured their businesses to align with their portfolios by divesting (AstraZeneca, Takeda) or spinning off their established primary care products into new companies (Pfizer, MSD), thereby sharpening their focus on their new innovations.

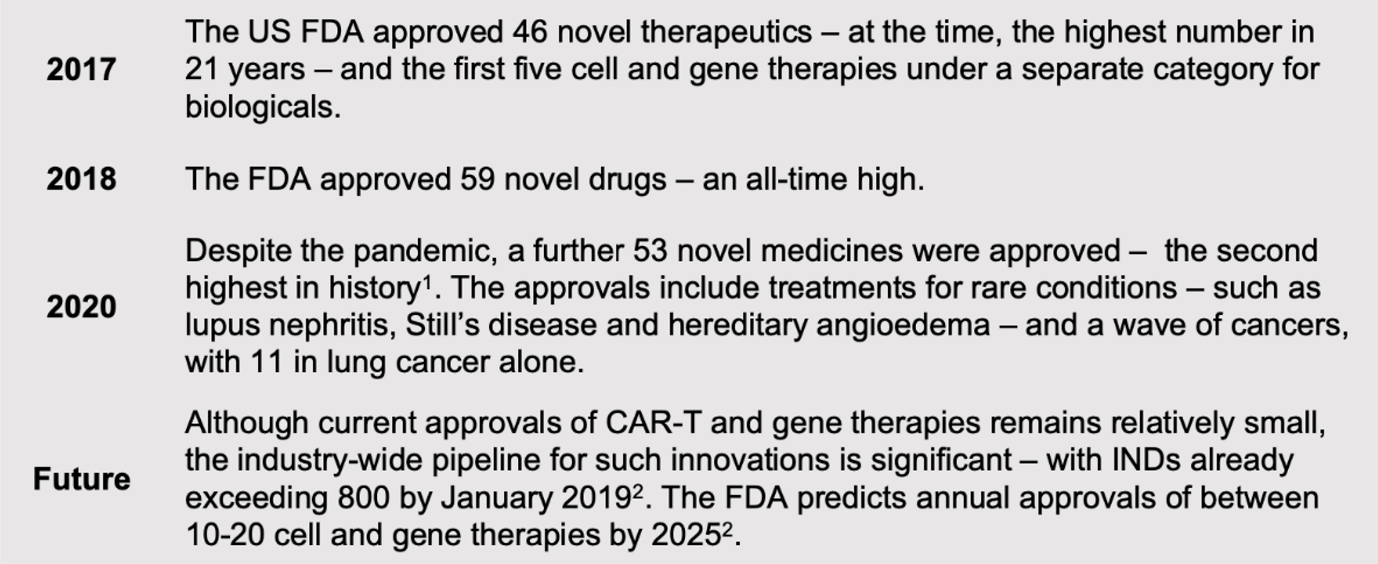

The second driver of this shift was the scientific revolution started by the mapping of the human genome. The market was increasingly dominated by therapies targeting specific disease pathways that serve much smaller patient populations, and this trend has accelerated since then as evidenced by FDA approvals over the past few years and going forward.

Source: 2020 FDA drug approvals

Source: 2020 FDA drug approvals

The third broader trend observed was that the R&D process, especially the scope and timelines of clinical development, hadn’t yet changed significantly over many years and this was partly driven by a regulatory pathway that still required large, lengthy trials. The result was that bringing a new drug to market still means an investment of more than $2 billion.

The past few years have seen some change in this dynamic, reflecting the nature of many of the new therapies. As drug candidates become more targeted, the risks of failure in early stages get reduced, while the focus on treating unserved patient populations has speeded up the clinical development and regulatory process under various accelerated schemes offered by the FDA and other agencies. Since early 2020, the remarkably fast development of the various COVID-19 vaccines, especially the new mRNA technology, has provided a glimpse of how these processes might be further streamlined in the future. At this point, however, the impact on drug development investment levels has not yet come through in a meaningful way.

The resulting combination of therapies with small target populations and high levels of investment together with shareholder pressure to replace revenue from old blockbusters has led to much higher drug prices with new treatments frequently topping $100,000 and beyond.

It is this new model that is crashing headlong into a payer agenda focused on cost containment and measurable value. Payers around the world are struggling to cope with pressures from aging populations and epidemics in chronic diseases and cancer as well as financial and political constraints on budgets. The COVID-19 pandemic has put further strain on healthcare systems and brought communicable diseases back to the top of government agendas. The key question then centers on the sustainability of a model based on small populations and higher prices.

Medical miracles – but at a cost

The original article was published soon after the approval of Novartis’ Kymriah as the first CAR-T gene therapy to come to market. These therapies represent a fundamental breakthrough in clinical value and, in many cases, are truly lifesaving. Even at the initial price of $475,000, it still demonstrated cost-effectiveness in treating patients who previously had few options. The oncoming wave of cell and gene therapies – with price levels in the hundreds of thousands of dollars – is driving a redefinition by leading payers about their priorities beyond just cost-effectiveness models. New thinking is evolving on how to evaluate treatment outcomes; when and how to pay for treatments (as well as how much); and even whether these therapies should be funded as medicines or as clinical procedures.

Payers with more limited resources may also need to consider the budget impact and opportunity cost of funding such breakthrough products. For example, for the same cost as providing a CAR-T therapy that saves the life of one patient, hundreds of children could receive a full childhood immunization schedule through their teen years. These sort of allocation decisions are increasingly becoming a factor, particularly in emerging markets with resource constraints and where the healthcare financing model is still a work in progress. The impact of COVID-19 has shown that even rich countries can be forced into painful trade-off decisions in allocating scarce resources.

Brave new world

Breakthrough treatments such as Kymriah are coming to market in a time of a broader transformation driven by technology. Some of these changes were already well under way in 2018 and have been accelerated by the global pandemic.

For example, apps on mobile phones and wearable devices such as smart watches are already enabling patients to take control of managing their own health as engaged and informed consumers. The pandemic drove many patients to access healthcare on telemedicine platforms that spanned a full consultation experience from diagnosis to prescription to payment to delivery, particularly in China where platforms such as WeDoctor (owned by Tencent, which also owns WeChat) are serving millions of patients every month.

At the same time, medical devices and diagnostics equipment are becoming smaller, cheaper, and digital, expanding patient care beyond the hospital walls. On the diagnostics side, the urgency of containing COVID-19 is driving rapid advances in the accurate detection and efficient delivery of the analysis to enable better clinical decisions. Companion diagnostics, such as the recent collaboration between Guardant Health and Janssen in lung cancer, are increasingly part of the value package presented to payers as well as clinicians.

Digital therapeutics – or therapies based solely on software – are now quickly emerging with the first FDA approval in late 2018 for reSET, a treatment for substance abuse disorder from Pear Therapeutics. These new therapies are being prescribed alongside and as alternatives to physical medicines and will increasingly be considered by payers in the same way.

These trends are now converging as mobile phones increasingly take on the role of diagnostic and treatment platforms for a variety of conditions, while they connect with medical devices through the Cloud. From a market access perspective, these trends are bringing an explosion of real-world data to be assessed for value.

A new model for the even newer normal

The basics of pricing, reimbursement, and time to market are still critically important – but no longer sufficient to meet the changes in the industry and the broader healthcare market environment. So how can we redefine the access model and repurpose it to meet the challenges arising over the next decade? We can start by looking differently at elements of the current market access model.

The new model of access strategy should build around four key pillars

PRMA Consulting®

PRMA Consulting®

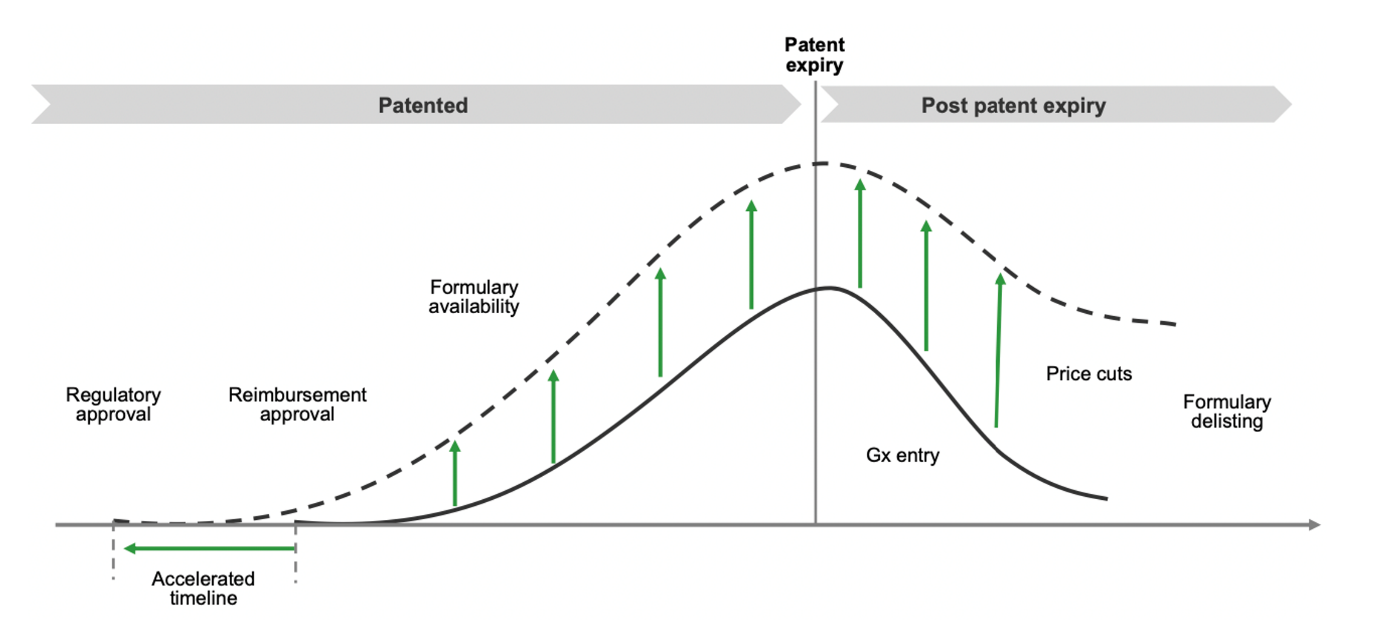

Pillar 1. Drive access and value across the product life cycle

Market access must play an active role throughout the product life cycle, from clinical development right through to post-patent expiry. Beyond the primary objective of reimbursement with acceptable price and guidelines, value can be created by shortening time to approval and thus advancing initial market sales. Market access can accelerate timelines through earlier collaboration on clinical trial design to identify payer value concerns as well as co-ordinated engagement with both regulators and payers on protocols and value messages.

Driving access and value across the product life cycle

PRMA Consulting®

PRMA Consulting®

Once the product has been reimbursed and launched, market access involves ensuring the availability of the therapy through formulary listings and pharmacy penetration using key account management and tender management where relevant.

As the product moves along its life cycle, market access must shift focus from value creation to value preservation involving pricing management, guideline expansion, and formulary status retention, ensuring availability of the product through formulary listings and retail penetration to accelerate sales growth. Patient support programs addressing affordability gaps and other initiatives such as disease management solutions, leveraging clinical and real-world data, can be used to expand or extend access even beyond patent expiry.

Pillar 2. Shift emphasis from product access to patient access (and outcomes)

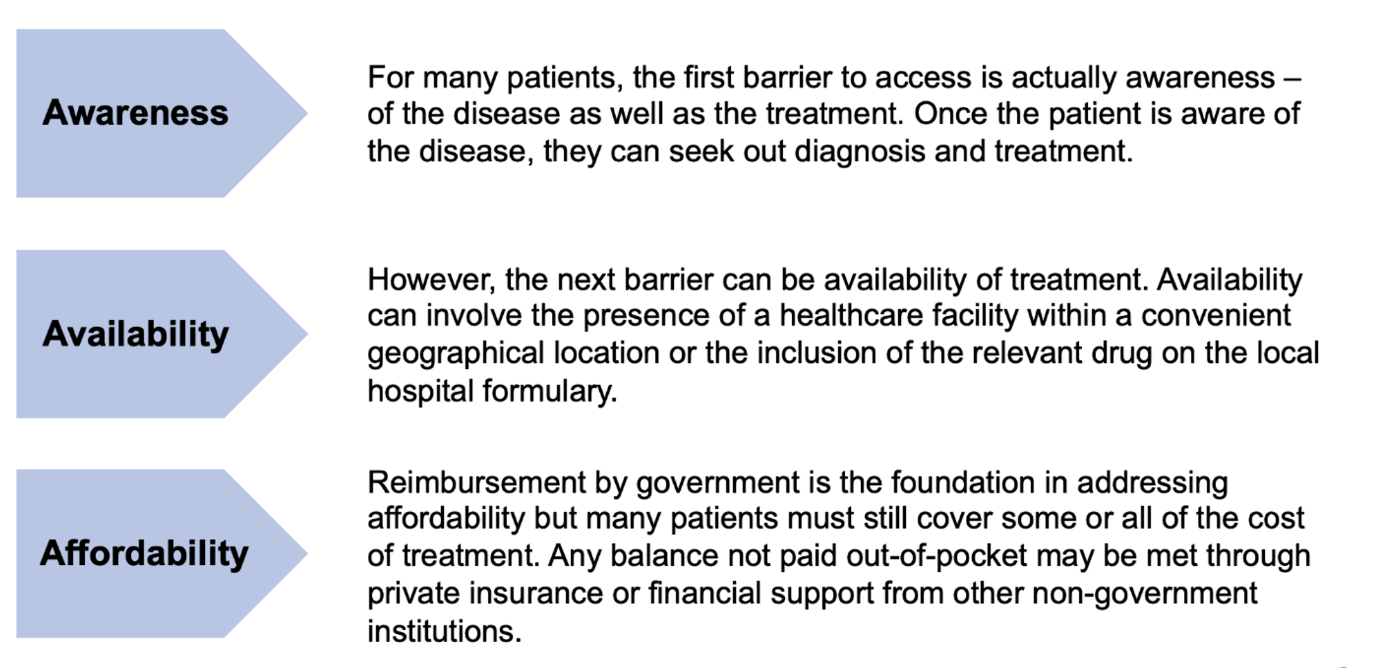

Patients are ultimately the most important stakeholder group but are often not at the center of a process more traditionally focused on attaining reimbursement for the products. From the patient’s perspective, access to care is the most critical concern, but the focus on reimbursement only addresses the barrier of affordability. Companies focusing on the patient also need to consider that patients will be balancing other roles such as employee, family member or even adherent of a particular religion.

Market access must now consider a more holistic approach that encompasses a broader view of the barriers faced by patients.

Shifting emphasis from product access to patient access (and outcomes)

PRMA Consulting®

PRMA Consulting®

For the patient, it doesn’t really matter if the drug is affordable if awareness and availability prevent them from getting to treatment in the first place. Market access must therefore shift more in the direction of the patient and address all three barriers to access. This is especially true in emerging markets where the relevant information and infrastructure are still developing. However, the COVID-19 pandemic has shown that awareness and availability can still form barriers for patients in developed markets as seen with the hesitancy of many to receive vaccinations as well as the ongoing supply issues in many countries.

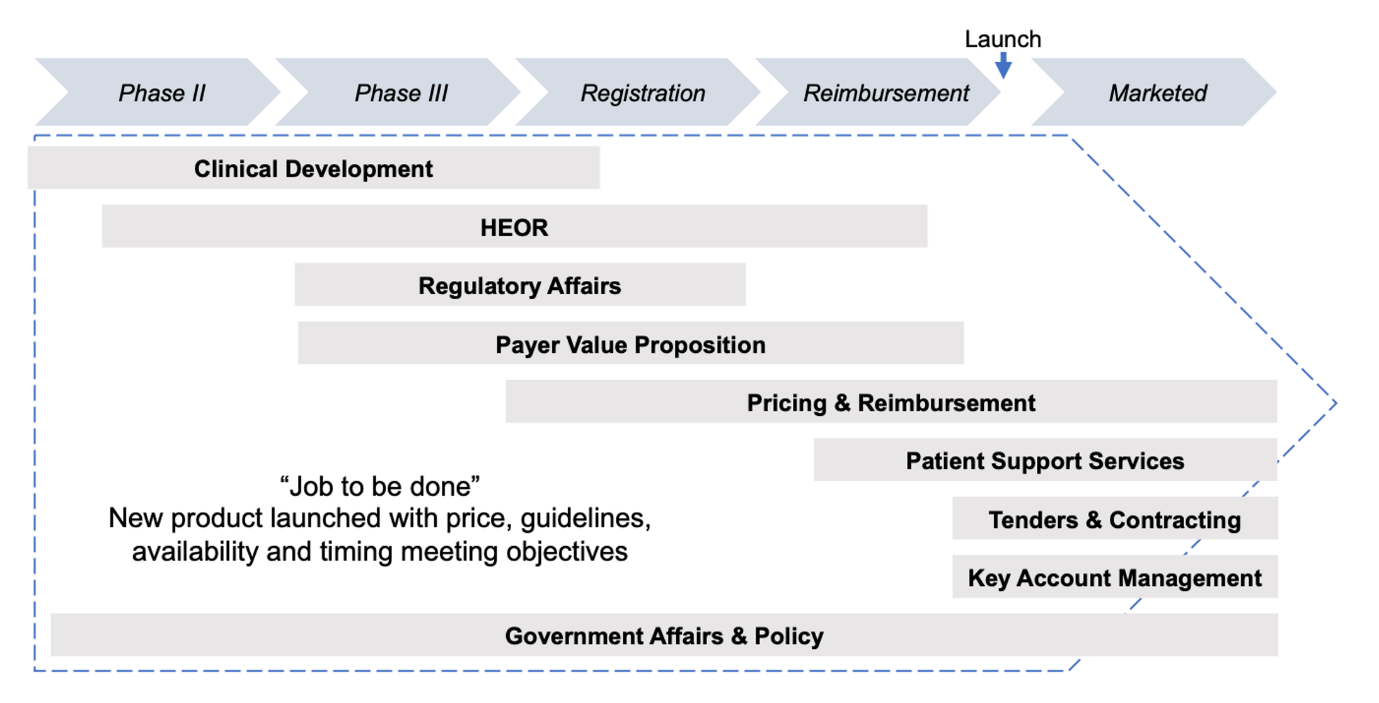

Pillar 3. Focus on the ‘job to be done’ – not the organization chart

A comprehensive and successful approach to market access can involve direct inputs from an array of functions within the organization, including government affairs, regulatory affairs, health economics and outcomes research (HEOR), pricing, tender management, and even key account management (KAM). Some companies have put a number of these functions under the umbrella of a market access function, while others have left legacy structures largely intact which can lead to uncertainty over responsibilities and accountability.

While there is no one-size-fits-all organizational structure for market access, it is essential that clear ownership of the overall access strategy and process sits with an empowered market access leader. This doesn’t mean that all of the above functional roles must report into the market access leader but instead points to an integrated program management office (PMO) approach. In this model, everyone involved aligns their efforts and their performance measures on the ‘job to be done’ of reimbursement approval, for example, regardless of formal reporting lines.

An integrated approach for market access

PRMA Consulting®

PRMA Consulting®

The job of market access – indeed the job of the biopharmaceutical company – is to ensure that breakthrough and essential therapies are as available as possible to everyone that needs them. An integrated access strategy will have inputs from across the organization, but irrespective of reporting structure, everything (and everyone) should be aligned around this single, shared purpose.

Pillar 4. Add ‘art’ to the science – embracing digital and business model innovation

Market access has evolved over time into more of a scientific technical function similar to regulatory affairs and focused on the process of submitting dossiers to government, but changes in the healthcare environment as well as the broader impact of technology require adding new creative thinking to the traditional toolkit, including lessons from commercial functions as well as from other businesses outside the healthcare sector. These new technologies and models can help add creative ‘art’ to the ‘science’ of innovation.

Data and digital solutions are already impacting the way pharma companies conduct R&D as well as marketing and sales by enabling new ways to engage with stakeholders across the value chain, including patients and payers. Outcomes-based payment models, for example, are made possible by data captured by digital devices and analyzed using AI tools that are effectively ‘real world in real time.’

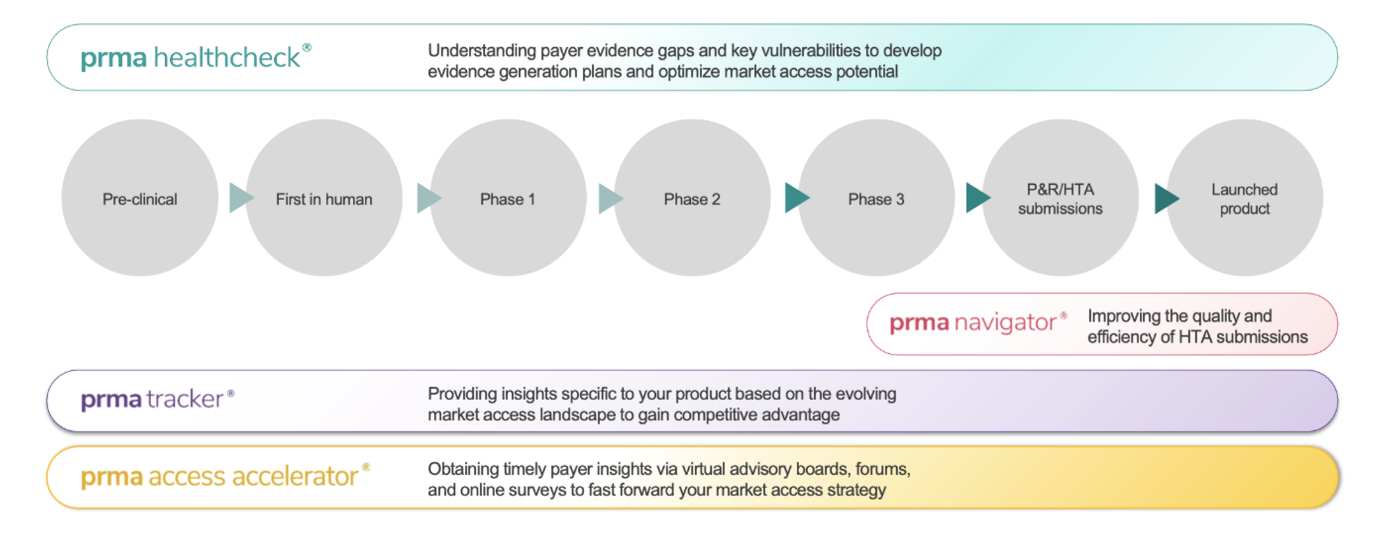

For example, the PRMA Healthcheck® digital application drives successful country reimbursement submissions across markets.

PRMA Healthcheck®: maximizing value of your assets at all stages of development

PRMA Consulting®

PRMA Consulting®

Disruptive business models can help access expansion initiatives move from product pricing to ongoing care offerings for chronic disease.

Adoption of digital technologies, and the development of innovative business models, has been accelerated by COVID-19. In many cases, emerging markets have been leading the way in using technology to change the way patients can access medicines. For example, telemedicine providers in Southeast Asia linked with ‘super apps’ Grab and Gojek are reaching millions of people on platforms that started with ride hailing and now have expanded into delivery and financial services.

Some companies are exploring how technology can be used to fund medicines. The global think tank ACCESS Health International has led an initiative called Fintech for Health which brings together biopharmaceutical companies with fintech players to look at the potential convergence of financial and health inclusion through payment solutions, microfinance platforms, insurtech offerings, and other new models. Reverse innovation is now bringing some of these new models back to the US and other developed markets.

Don’t be afraid of the ‘P’ word – engage in open dialog about price and value

Finally, the biopharma industry often acts like ‘price’ is a word not to be uttered in polite company and prefers to focus on the ‘value’ of innovative drugs when discussing with payers and other stakeholders.

As healthcare moves more towards value-based models, it is critical that all the stakeholders agree on what ‘value’ means. The industry position is that biopharmaceutical companies should be compensated for the value of their past and future investment in innovation in order to ensure continued R&D on new therapies. The value of innovation to industry then gets measured mostly in terms of higher price. Value to payers, on the other hand, is aimed at providing the best possible healthcare to the most patients given the resources they have available and so focuses on reducing costs.

Since price merely reflects the mutually agreed point where these different perceptions of value meet, both sides should strive for open dialog on price and value that aims for bringing these positions more into alignment.

The road ahead

While positive healthcare reforms are back on the agenda in the US, other parts of the world continue to move ahead. Governments in other mature markets are increasingly shifting towards a focus on outcomes and value-based healthcare while many emerging markets are implementing universal health insurance coverage. The biopharmaceutical industry’s transformation towards specialty medicines has accelerated as breakthrough therapies come to market. Powerful new entrants from outside the healthcare sector, such as Amazon and Apple, together with an array of start-ups, are introducing new technologies such as blockchain and machine learning that are starting to disrupt business models and impact policy. These trends then require a new approach to market access that will meet the changing needs of patients, payers, physicians, and even the companies and their products themselves.

So what does all this mean? As companies seek to maintain value in established markets, the strategic importance of market access is only growing – and the need for an integrated 360 approach is becoming ever clearer. Alongside it, companies are increasingly turning to emerging markets as drivers of growth – and they’re finding the access challenges there are even more pronounced. There’s a growing focus on the Asia‑Pacific region, not least because one of the emerging markets in the region – China – is now the second largest in the world, having overtaken neighboring Japan in 2017.

Biopharmaceutical companies have traditionally viewed markets in Asia-Pacific as elsewhere through a lens of being either ‘reimbursed’ or ‘self-pay’ and have developed and implemented market access strategies accordingly. The reality has never been quite so binary, and in fact is increasingly out of date as emerging market governments across the region commit to providing universal healthcare coverage to their citizens, even if many new therapies are not yet included in that coverage. More broadly, one feature that unites markets across the region – at all stages of development – is an ‘access gap’, where new medicines typically are launched one to two years behind the US and Europe, often at lower prices and even with more restricted guidelines. Companies must address this access gap if they are to realize the value and growth potential of this large, dynamic, and diverse region.

With Asia‑Pacific presenting big opportunities for growth, closing the access gap is a major priority. How do you do it? We’ll continue to explore potential strategies for both developed and emerging markets in future articles so please subscribe for the updates.

- 2020 FDA drug approvals

- New policies to advance development of safe and effective cell and gene therapies

PRMA Consulting is an independent, specialist consultancy solving some of the most challenging market access issues facing pharmaceutical and biotechnology companies today. www.prmaconsulting.com