Singapore's Fortitude Budget Announcement

On 26th May 2020, DPM Heng Swee Keat announced a further $33bn Fortitude Budget to extend support to Singaporeans and businesses from the impacts of COVID-19. This is Singapore's fourth budget announcement since February.

For full details of all the budget announcements visit the government's dedicated website here. Below are the relevant highlights of the Fortitude Budget:

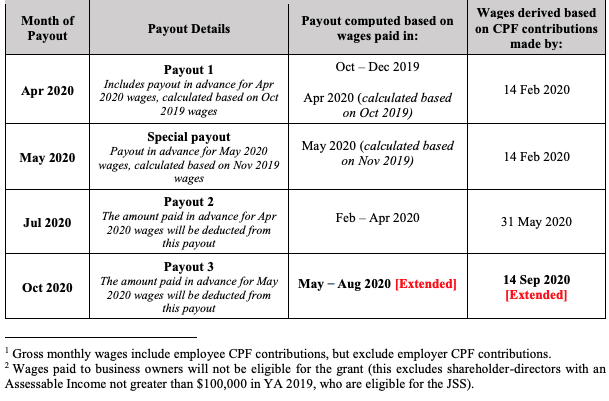

- The Enhanced Jobs Support Scheme, which has been supporting companies with up to 75% coverage of their local employee salaries, has been extended to include wages paid in August 2020, which will be paid in October, and with enhancements for specific sectors. Only employers who are not allowed to resume operations will continue to receive 75% support for wages paid to local employees, during the period for which they are not allowed to resume operations, or until August 2020, whichever is earlier. Pro-ration will be applied if operations resume in the middle of the month. For more information read the detailed statement from MOF.

Source: MOF

- For SME tenants (not more than $100 million in annual turnover) with qualifying leases or licences commencing before 25 March 2020, the Government will provide a new cash grant to offset their rental costs, in addition to the Property Tax Rebate for 2020 announced earlier.

- a) For qualifying SME tenants of qualifying commercial properties (e.g. shops), the Government will provide a new government cash grant of about 0.8 month’s of rent. Together with the Property Tax Rebate announced earlier for 2020 which property owners are required to pass on fully, this brings total government support to about two months for SME tenants of qualifying commercial properties.

- b) For qualifying SME tenants of other non-residential properties (e.g. industrial and office properties), the Government will provide a new cash grant of about 0.64 month’s of rent. Together with the Property Tax Rebate announced earlier for 2020, this brings total government support to about one month for SME tenants of other non-residential properties. SME property owners who run a trade or business on their own property will also be eligible for the new cash grant. Vacant property and land under development will not be eligible.

- For more information read the detailed announcement from MOF.

- The Minister for Law will introduce a new Bill next week. This will mandate that landlords contribute by granting a rental waiver to their SME tenants who have suffered a significant revenue drop in the past few months. The new Bill will also cover provisions on temporary relief from onerous contractual terms such as excessive late payment interest or charges. It will also allow tenants to repay their arrears through instalments. If the Bill is passed by Parliament, SME tenants in commercial properties who have suffered a significant revenue drop will benefit from a total of four months of rental relief – shared equally between the Government and landlords.

- A bonus of up to $1,500 ($300 per month, over a period of five months) will be given to encourage stallholders to adopt the NETS Singapore QR e-payment solution. The bonus is contingent on sustained use of the e-payment solution, with a minimum number of e-payment transactions per month. The Government will also bear the transaction fees (i.e. merchant discount rate payable by merchants) until 31 December 2023. For more information read the detailed announcement from MOF.

-

Introduction of a Digital Resilience Bonus to help businesses take their next step, starting with the F&B and retail sectors. Eligible businesses can receive a payout of up to $5,000 if they adopt PayNow Corporate and e-invoicing, as well as business process or e-commerce solutions

- Extension of the Foreign Worker Levy waiver for up to two months for businesses who are not allowed to resume operations.

- SGUnited Jobs and Skills Package, to create close to 100,000 opportunities in three areas – 40,000 jobs, 25,000 traineeships and 30,000 skills training.